U.S. dollar

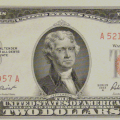

The US dollar is the official currency of the United States of America, symbolized by the $ symbol. One dollar is divided into 100 cents. There are various denominations of banknotes in circulation, including 100, 50, 20, 10, 5, 2 (which is rare), 1 dollar, as well as coins in denominations of 1 dollar, 50, 25, 10, 5 and 1 cent. Previously, notes were used in denominations of $500, $1,000, $5,000, $10,000 and $100,000, but these were phased out in 1969 as electronic payments were introduced.

The name of the monetary unit, according to a common version, comes from the medieval thaler coin minted in Germany.

The obverse of the U.S. dollar bill typically features images of presidents and political figures of the United States. For example, the $100 bill features Benjamin Franklin. On the reverse side of the note you can see historical monuments such as Independence Hall or the Lincoln Memorial.

To prevent counterfeiting, dollar designs are changed periodically, usually every 7-10 years. All US banknotes issued since 1861 are legal tender in the country.

US dollars were adopted by Congress in 1786 and became the country's primary currency in 1792. The principle of a bimetallic monetary unit was introduced, in which both silver and gold coins were minted.

At the end of World War II, the dollar became the world's main currency exchanged for gold. However, crises and US deficits led to the abandonment of the gold standard in 1971.

Although the dollar may fluctuate due to various factors such as economic crises or political events, its stability is supported by the country's economic strength and investor confidence.

At the moment, the US dollar remains the leading currency in the world economy, used for international payments and trade. Experts have different points of view regarding its future, but the stability of the dollar is based on the country's strong economic performance and the policies of the Federal Reserve System.

US dollar banknotes feature images of famous presidents and political figures of the country. In particular, the following persons appear on modern banknotes:

- $100 – Benjamin Franklin;

- $50 – Ulysses Grant;

- $20 – Andrew Jackson;

- $10 – Alexander Hamilton;

- 5 dollars – Abraham Lincoln;

- 2 dollars – Thomas Jefferson;

- 1 dollar – George Washington.

The reverse side of the banknotes also depicts significant historical places:

- $100 – Independence Hall, where the Declaration of Independence was signed;

- $50 – Capitol;

- $20 – White House;

- 10 dollars – US Treasury;

- $5 – Lincoln Memorial in Washington.

Separately, it is worth mentioning the $1 banknote, on the reverse side of which there is a special design - a double-sided image of the so-called Great Seal of the United States. This drawing is used to authenticate documents issued by the government and is kept in Washington.

In 1900, the gold standard law was passed. At that time, 1 dollar was equivalent to 1.50463 grams of pure gold. However, in 1933 there was the first devaluation of the dollar by 41%, caused by the "gold knot". As a result, the cost of an ounce of gold was set at $35.

At the end of World War II, the dollar became the only currency that could be exchanged for gold. By that time, the rates of other world currencies were pegged to the US dollar. The post-war years also saw the United States become Europe's main creditor. These events made the US dollar the world's currency of account and strengthened its position in central bank reserves.

However, by 1960, chronic US current account deficits meant that the number of dollars held by creditors around the world exceeded the size of the country's gold reserves. This situation was aggravated by the crisis of 1969-70. As a result of the consequences of this crisis, in 1971, President Richard Nixon announced a complete end to the exchange of dollars for gold.

During the 1970s, the dollar continued to depreciate, and the crisis of 1975-76 only made the situation worse. In 1976, an international agreement created a new currency system - a system of “floating” exchange rates, which finally legitimized the abandonment of gold backing of currencies.

The strengthening of the dollar in the 1980s put American manufacturers at a disadvantage relative to other countries. In response to this, a decision was made to devalue the dollar by cutting interest rates. By 1991, the exchange rate of the dollar against the Japanese yen, British pound and German mark had been effectively halved.

In 1992, as a result of the fall of the British pound sterling and the crisis in Europe, the dollar rose in price by almost 30%, but from April 1993 its quotes began to decline again - until 1998, when there was a significant weakening of the dollar against the Japanese yen - from 136 to 111 within three days. This was due to the massive repatriation of funds from Japanese investors as a result of the crisis in the markets of developing countries, including Russia. The years 1999-2001 saw a new strengthening of the US dollar, which was stopped by the Federal Reserve, which lowered interest rates to 2% in order to stimulate the economy. The most important event for the dollar was the creation in 1999 of the European Monetary System, into which the central banks of many creditor countries of the United States transferred part of their reserves. For the summer of 2011, the US dollar is quoted in the range of 1.40-1.46 dollars per euro, 76-78 Japanese yen per dollar and 1.62-64 dollars per pound. Despite competition from the euro, today the United States currency occupies a leading place in the reserves of central banks. In addition, it remains the main currency of account between countries in international trade, and is also the base currency for payments through payment systems outside the European Union zone, where the euro predominates.

The US dollar is the main currency in the forex market. Transactions take place through this currency and basic quotes are set.

Experts' opinions regarding the future of the dollar are diametrically opposed. On the one hand, many believe that the collapse of the dollar financial system is inevitable in the near future due to the huge foreign debt of the United States, the largest in the world. As of the summer of 2011, it exceeds $14.5 trillion.

On the other hand, the stability of the dollar is based on strong economic indicators. The US economy ranks first in terms of GDP, almost two times ahead of China, which is in second position. In addition, the high dollar exchange rate is facilitated by the cautious policy of the Federal Reserve System, as well as the faith of investors who keep their assets in American currency and during crises seek to transfer them into dollars, finding refuge in US debt instruments from the elements of a market economy.

In 1900, the gold standard law was passed. At that time, 1 dollar was equivalent to 1.50463 grams of pure gold. However, in 1933 there was the first devaluation of the dollar by 41%, caused by the "gold knot". As a result, the cost of an ounce of gold was set at $35.

At the end of World War II, the dollar became the only currency that could be exchanged for gold. By that time, the rates of other world currencies were pegged to the US dollar. The post-war years also saw the United States become Europe's main creditor. These events made the US dollar the world's currency of account and strengthened its position in central bank reserves.

Attached Files

Купюра 1 Доллар 1917 года

Купюра 1 Доллар 1917 года Купюра 1 Доллар 1928 года

Купюра 1 Доллар 1928 года Купюра 1 Доллар 1935 года

Купюра 1 Доллар 1935 года Купюра 1 Доллар 1963 года

Купюра 1 Доллар 1963 года Купюра 1 Доллар 1993 года

Купюра 1 Доллар 1993 года Купюра 1 Доллар 2009 года

Купюра 1 Доллар 2009 года Купюра 2 доллара 1862 года (реверс)

Купюра 2 доллара 1862 года (реверс) Купюра 2 доллара 1862 года

Купюра 2 доллара 1862 года Купюра 2 доллара 1869 года

Купюра 2 доллара 1869 года Купюра 2 доллара 1869 года (реверс)

Купюра 2 доллара 1869 года (реверс) Купюра 2 доллара 1869 года

Купюра 2 доллара 1869 года Купюра 2 доллара 1869 года (реверс)

Купюра 2 доллара 1869 года (реверс) Купюра 2 доллара 1886 года

Купюра 2 доллара 1886 года Купюра 2 доллара 1886 года (реверс)

Купюра 2 доллара 1886 года (реверс) Купюра 2 доллара 1896 года

Купюра 2 доллара 1896 года Купюра 2 доллара 1896 года (реверс)

Купюра 2 доллара 1896 года (реверс) Купюра 2 доллара 1899 года

Купюра 2 доллара 1899 года Купюра 2 доллара 1899 года (реверс)

Купюра 2 доллара 1899 года (реверс) Купюра 2 доллара 1918 года

Купюра 2 доллара 1918 года Купюра 2 доллара 1918 года (реверс)

Купюра 2 доллара 1918 года (реверс) Купюра 2 доллара 1928 года

Купюра 2 доллара 1928 года Купюра 2 доллара 1928 года (Реверс)

Купюра 2 доллара 1928 года (Реверс) Купюра 2 доллара 1953 года

Купюра 2 доллара 1953 года Купюра 2 доллара 1995 года

Купюра 2 доллара 1995 года Купюра 2 доллара 2003 года

Купюра 2 доллара 2003 года Купюра 2 доллара 2013 года

Купюра 2 доллара 2013 года

Read together with it:

- Valley of Fear - AudiobookThe novel The Valley of Fear begins with Sherlock Holmes, the famous detective, and Dr. Watson, his companion and roommate at 221B Baker Street, having a conversation. Holmes is puzzling over a coded message he has received from Porlock, an accomplice of Holmes's arch-enemy, Professor Moriarty. Soon a second message arrives from Porlock, which is supposed to contain the key to the coded message, s...